Copyright © 2024 Swire Pacific Limited. All rights reserved.

The Cathay Pacific Group today released its combined traffic figures for August 2020 that reflected the airlines' continued substantial capacity reductions in response to significantly reduced demand as well as travel restrictions and quarantine requirements in place in Hong Kong and other markets amid the ongoing global COVID-19 pandemic.

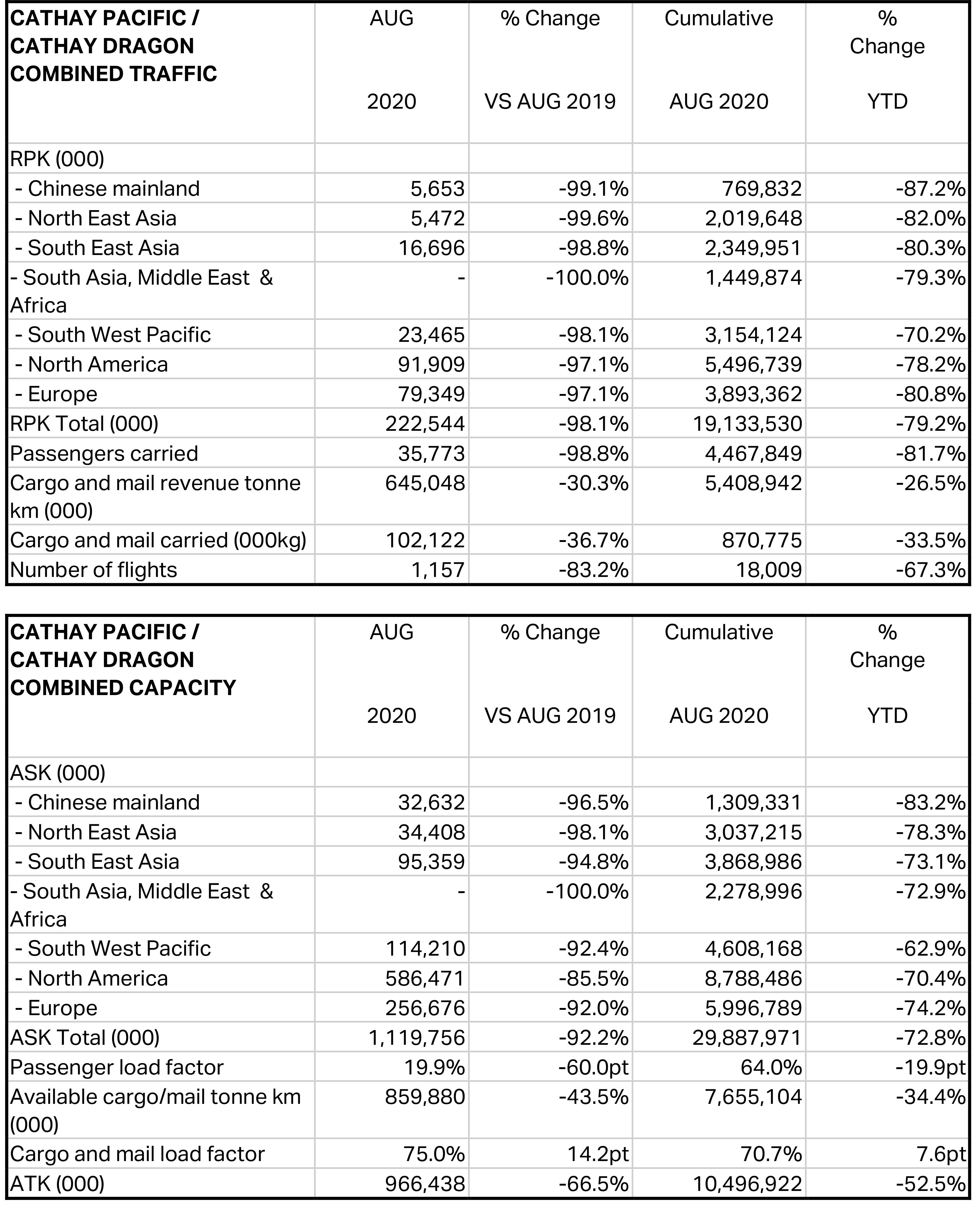

Cathay Pacific and Cathay Dragon carried a total of 35,773 passengers last month, a decrease of 98.8% compared to August 2019. The month's revenue passenger kilometres (RPKs) fell 98.1% year-on-year. Passenger load factor dropped by 60 percentage points to 19.9%, while capacity, measured in available seat kilometres (ASKs), decreased by 92.2%. In the first eight months of 2020, the number of passengers carried dropped by 81.7% against a 72.8% decrease in capacity and a 79.2% decrease in RPKs, as compared to the same period for 2019.

The two airlines carried 102,122 tonnes of cargo and mail last month, a decrease of 36.7% compared to August 2019. The month's revenue freight tonne kilometres (RFTKs) fell 30.3% year-on-year. The cargo and mail load factor increased by 14.2 percentage points to 75%, while capacity, measured in available freight tonne kilometres (AFTKs), was down by 43.5%. In the first eight months of 2020, the tonnage fell by 33.5% against a 34.4% drop in capacity and a 26.5% decrease in RFTKs, as compared to the same period for 2019.

Cathay Pacific Group Chief Customer and Commercial Officer Ronald Lam said: "It is clear that we are facing a long and uncertain road to recovery. The entire aviation industry has been hit hard by COVID-19 and the environment will continue to be extremely challenging for many years. The International Air Transport Association (IATA) has pushed back its forecast for passenger recovery by a year to 2024, demonstrating just how slow a return to pre-pandemic levels will be.

"We have already taken decisive actions to reduce our costs, but despite these efforts we are burning cash at a rate of HK$1.5 billion to HK$2 billion per month, and will continue to experience significant cash burn until the market recovers. The recapitalisation provides us time and a platform from which to transform our business and continue to operate in the short term; however, it is an investment that we need to repay.

"We are weathering the storm for now, but the fact remains that we simply will not survive unless we adapt our airlines for the new travel market. A restructuring will therefore be inevitable to protect the company, the Hong Kong aviation hub, and the livelihoods of as many people as possible. We continue to move forward with our comprehensive review of all aspects of the business, and will make our recommendations to the board in the fourth quarter on the size and shape of the company to allow us to survive and thrive in this new environment."

Outlook

"Looking ahead, we are cautiously optimistic of a reasonably promising cargo peak season, having received strong pre-orders that will serve the capacity needs of our customers. Beyond the traditional peak season, however, prospects are very unclear. Regional geopolitical tensions and the ongoing China-US trade dispute could have a significant adverse effect on airfreight demand, and the situation has the potential to deteriorate rapidly."

"On the passenger demand front, we still haven't seen solid signs of immediate improvement. We have therefore revised our operating passenger flight capacity down to about 10% in September and similar levels in October, subject to the further relaxation or tightening of travel restrictions and quarantine requirements.

"We welcome and are encouraged by the efforts of the HKSAR Government to engage in discussions with 11 countries on the establishment of travel bubbles. We look forward to further relaxation measures in future that will help revitalise travel activities and ensure the continued strength and importance of Hong Kong as a global aviation hub."

"Given that we will be operating just a fraction of our services in the foreseeable future, we will continue to transfer some of our passenger fleet - approximately 40% - to locations outside of Hong Kong in keeping with prudent operational and asset management considerations."