Copyright © 2024 Swire Pacific Limited. All rights reserved.

Cookies and Privacy: We use cookies to enhance your user experience on our website. Please indicate your cookie preference. For more information, please read our Cookie Policy and Privacy Notice.

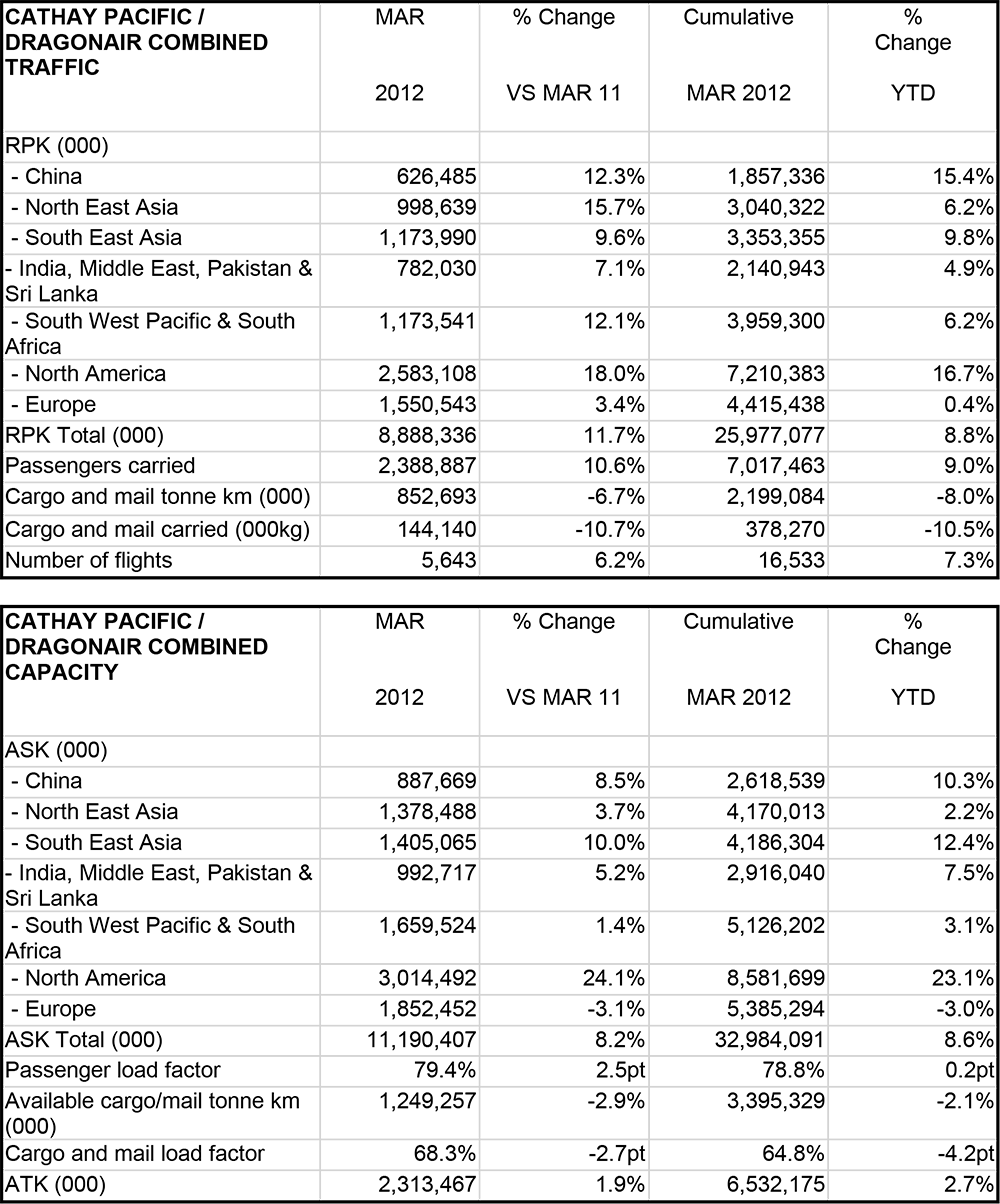

Cathay Pacific Airways today released combined Cathay Pacific and Dragonair traffic figures for March 2012 that show the growth in passenger numbers rising ahead of capacity growth, while cargo and mail tonnage declined compared to the same month last year.

Cathay Pacific and Dragonair carried a total of 2,388,887 passengers in March - up 10.6% on the same month in 2011 - while the passenger load factor rose by 2.5 percentage points to 79.4%. Capacity for the month, measured in available seat kilometres (ASKs), was up by 8.2%. For the first quarter of this year, passenger numbers have risen by 9.0% compared to a capacity climb of 8.6%.

The two airlines carried 144,140 tonnes of cargo and mail last month, a drop of 10.7% compared to March 2011. The cargo and mail load factor was down by 2.7 percentage points to 68.3%. Capacity, measured in available cargo/mail tonne kilometres, decreased by 2.9%, while cargo and mail tonne kilometres flown dropped by 6.7%. For the first quarter, tonnage has declined by 10.5% while capacity is down by 2.1%.

Cathay Pacific General Manager Revenue Management James Tong said: "Passenger volumes were generally robust in March, though year-on-year comparisons are distorted somewhat by the negative impact of last year's earthquake and tsunami in Japan. The big issue at the moment is the accelerating yield decline in both the Economy and premium cabins, resulting from a combination of the continuing economic uncertainty and competitive pressure."

Cathay Pacific General Manager Cargo Sales & Marketing James Woodrow said: "March was the strongest month of the year so far for our cargo business. This was thanks to large shipments of hi-tech consumer products from China to key markets around the world combined with capacity reductions by both Cathay Pacific and our competitors. However, the general market for airfreight remains soft, particularly into Europe. There is poor visibility looking forward and little sign of any sustained pick-up in demand. We expect business to be weaker in April and we will continue to reduce capacity as necessary."