Copyright © 2024 Swire Pacific Limited. All rights reserved.

Cookies and Privacy: We use cookies to enhance your user experience on our website. Please indicate your cookie preference. For more information, please read our Cookie Policy and Privacy Notice.

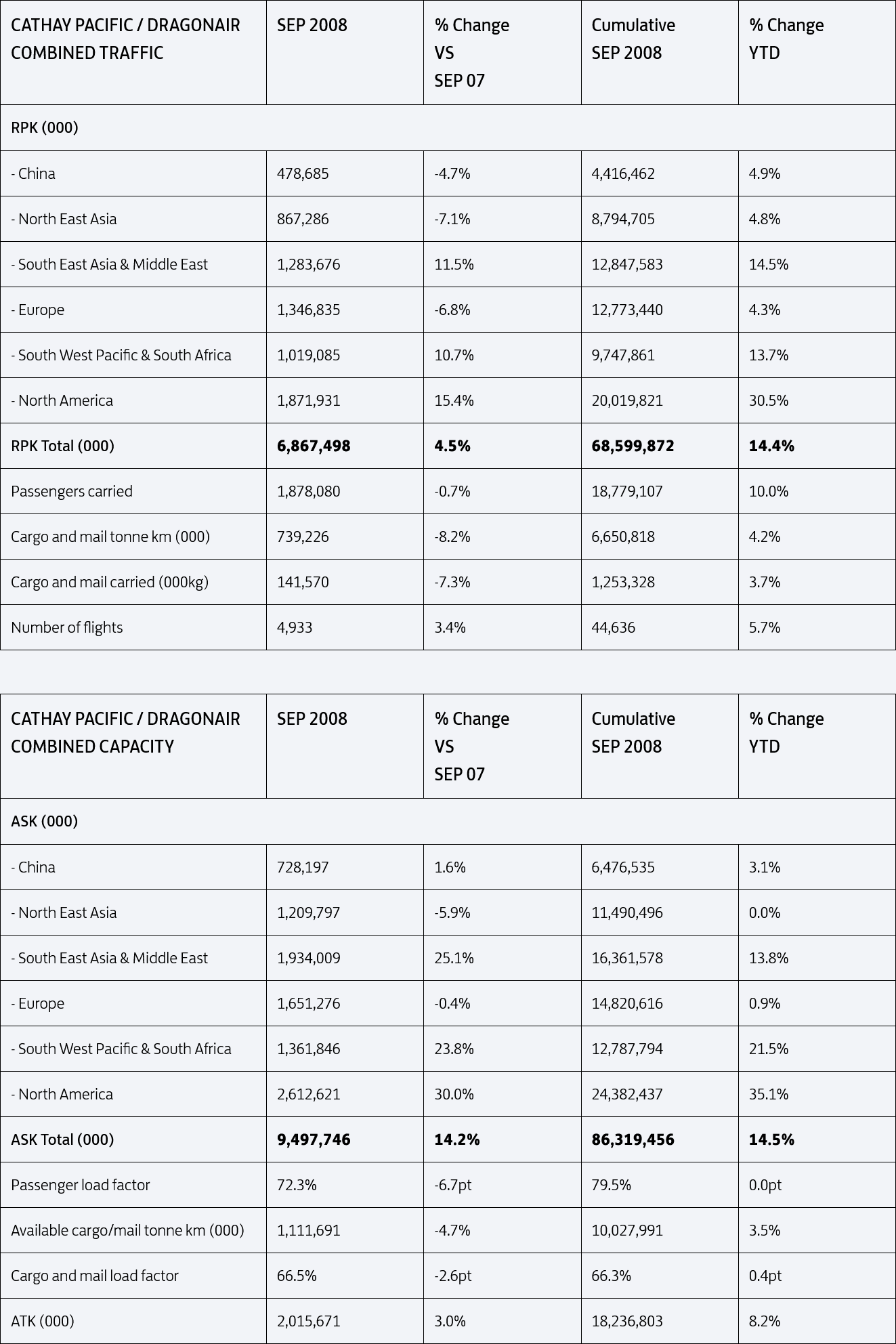

Cathay Pacific Airways today released combined Cathay Pacific and Dragonair traffic figures for September 2008 that show a fall in both passenger numbers and cargo and mail tonnage compared to the same month last year.

Last month Cathay Pacific and Dragonair carried a total of 1,878,080 passengers - a decline of 0.7% on the same month in 2007. This compares to a 14.2% growth in capacity, measured in available seat kilometres (ASKs), over the same period. The month's load factor was down 6.7 percentage points to 72.3%. For the year to date, the number of passengers carried has risen by 10.0% compared to a capacity rise of 14.5%.

Between them, the two airlines carried a total of 141,570 tonnes of cargo and mail in September - a drop of 7.3% on the same month in 2007 against a 4.7% fall in capacity, measured in available cargo/mail tonne kilometres. The cargo and mail load factor fell by 2.6 percentage points to 66.5%. For the year to date, cargo and mail tonnage has climbed by 3.7% compared to a capacity rise of 3.5%.

Cathay Pacific General Manager Revenue Management Tom Owen said: "We saw a further softening of our passenger business during September. Demand out of our biggest market, Hong Kong, slowed significantly, particularly on the corporate sales side, while typhoons in Hong Kong and Taiwan and the post-Olympics lag also impacted revenues. Looking forward, we continue to see a softening in advance bookings, particularly for the premium cabins and in those sales territories more exposed to the financial services sector."

Cathay Pacific General Manager Cargo Sales & Marketing Titus Diu said: "The expected post-Olympics surge from Mainland China didn't materialise and there was also no significant rush before either the Mid-Autumn Festival or National Day holidays. Our uplift was also affected by Typhoon Hagupit and other tropical storms during the month. Currently, the only market showing consistent weakness is Northeast Asia, though the situation could change in the aftermath of the recent financial crisis."