Copyright © 2024 Swire Pacific Limited. All rights reserved.

Cookies and Privacy: We use cookies to enhance your user experience on our website. Please indicate your cookie preference. For more information, please read our Cookie Policy and Privacy Notice.

Cathay Pacific today released its traffic figures for November 2020 that continued to reflect the airline's substantial capacity reductions in response to significantly reduced demand as well as travel restrictions and quarantine requirements in place in Hong Kong and other markets amid the ongoing global COVID-19 pandemic.

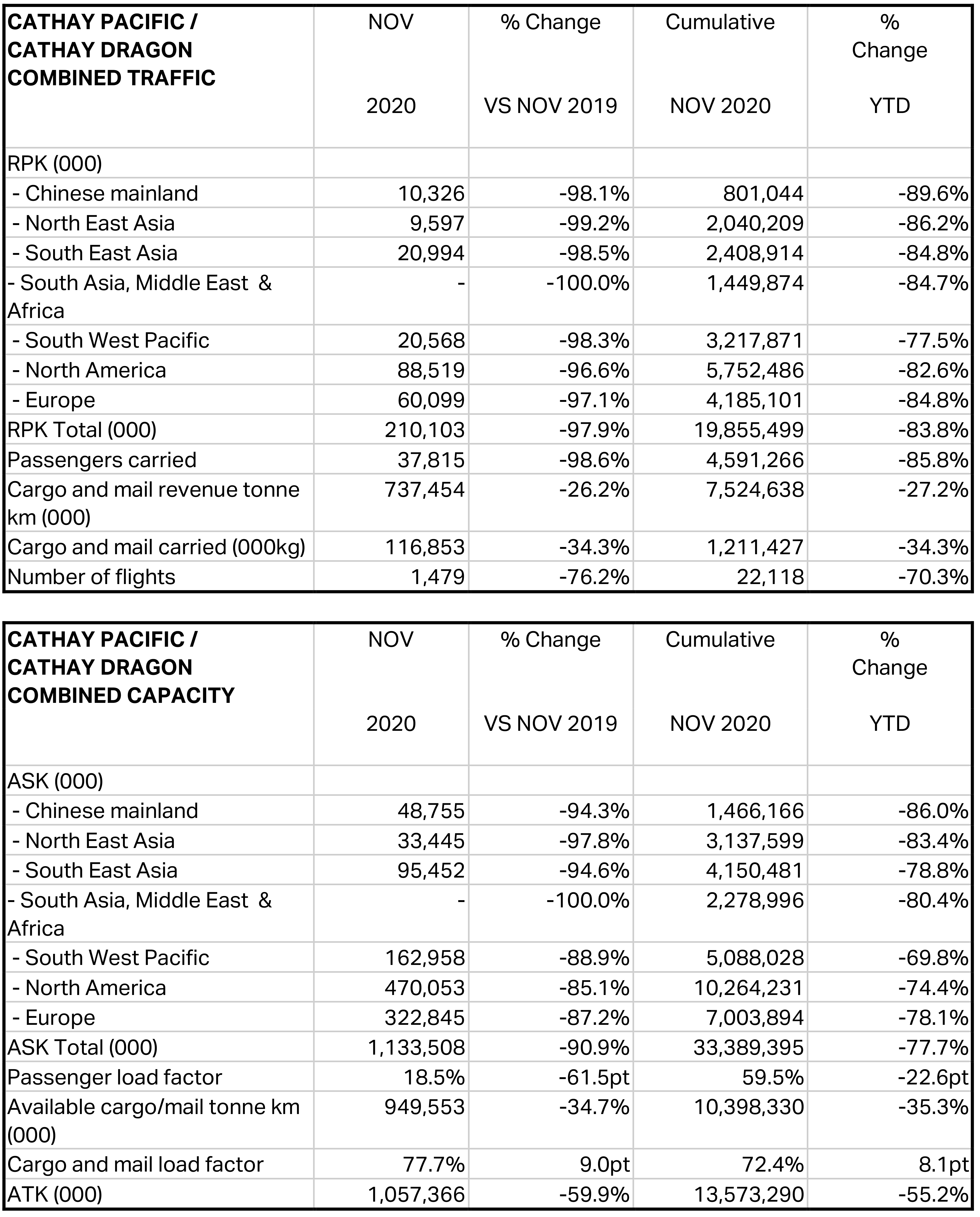

Cathay Pacific carried a total of 37,815 passengers last month, a decrease of 98.6% compared to November 2019. The month's revenue passenger kilometres (RPKs) fell 97.9% year-on-year. Passenger load factor dropped by 61.5 percentage points to 18.5%, while capacity, measured in available seat kilometres (ASKs), decreased by 90.9%. In the first 11 months of 2020, the number of passengers carried by Cathay Pacific and Cathay Dragon dropped by 85.8% against a 77.7% decrease in capacity and an 83.8% decrease in RPKs, as compared to the same period for 2019.

Cathay Pacific carried 116,853 tonnes of cargo and mail last month, a decrease of 34.3% compared to November 2019. The month's revenue freight tonne kilometres (RFTKs) fell 26.2% year-on-year. The cargo and mail load factor increased by 9.0 percentage points to 77.7%, while capacity, measured in available freight tonne kilometres (AFTKs), was down by 34.7%. In the first 11 months of 2020, the tonnage carried by Cathay Pacific and Cathay Dragon fell by 34.3% against a 35.3% drop in capacity and a 27.2% decrease in RFTKs, as compared to the same period for 2019.

Outlook

"Looking ahead on the passenger front, we still are not seeing significant demand for travel as we head towards the end of 2020 - traditionally a strong travel season in the year. Demand continues to weaken on long-haul routes and we anticipate we will rely more on traffic on regional services in the immediate future. Given the slow speed of recovery, we expect to operate about 9% of pre-COVID-19 capacity in December and slightly above 10% in January 2021.

"The December capacity results in the average capacity for the second half of 2020 being 8.4% of pre-COVID-19 level, compared to the average capacity of 34.3% in the first half. This, together with the additional restructuring and impairment costs announced in October, and further aircraft impairment at year-end, is expected to result in the second-half losses being significantly higher than the first-half losses reported in our interim accounts.

"From a cargo perspective, we will soon launch a seasonal cargo service into Hobart in Australia beginning mid-December to support exports of fresh produce from Tasmania into different parts of Asia. In terms of specialised products, the airline along with our cargo terminal and ground-handling subsidiaries have been re-certified with IATA's CEIV Pharma accreditation, and we are actively preparing ourselves to meet the challenge of shipping temperature- and time-sensitive vaccines across our network when the time arises."