Copyright © 2024 Swire Pacific Limited. All rights reserved.

Swire Pacific is committed to ensuring that its affairs are conducted in accordance with its corporate and governance culture and values of integrity, originality, excellence, humility, teamwork, continuity and high ethical standards, which form a coherent set of principles that are relevant across the Company’s business and underpin everything it does. This reflects its belief that, in the achievement of its long-term objectives, it is imperative to act with probity, transparency and accountability. By so acting, Swire Pacific believes that shareholder value will be maximised in the long term and that its employees, those with whom it does business and the communities in which it operates will all benefit.

Corporate governance is the process by which the Board instructs management of the Group to conduct its affairs with a view to ensuring that its objectives are met. The Board is committed to maintaining and developing robust corporate governance practices that are intended to ensure:

• satisfactory and sustainable returns to shareholders

• that the interests of those who deal with the Company are safeguarded

• that overall business risk is understood and managed appropriately

• the delivery of high-quality products and services to the satisfaction of customers

• that high standards of ethics are maintained

• a commitment to sustainable development which supports long-term growth.

The Board provides guidance to management by defining the purpose, values and strategic direction of the Group, and plays an important role in establishing and instilling a culture that reinforces the values of acting lawfully, ethically and responsibly. The Company’s Corporate Code of Conduct ensures that the corporate culture and expected behaviours are clearly communicated to everyone in the Group. Appropriate policies and procedures are in place to promote and reinforce the need for employees and others who deal with the Company to act with honesty and integrity and to raise concerns about actual or suspected cases of impropriety. Indicators used for assessing and monitoring social and corporate governance related data (including staff turnover rates, whistleblowing data, and breaches of the Company’s Corporate Code of Conduct) are set out in the 2024 Sustainability Report of the Company. The Group offers competitive remuneration and benefits designed to attract, motivate and retain talented people at all levels. Having regard to the corporate culture reflected in the policies and practices of the Group, the Board is satisfied that the purpose, values and strategic directions of the Group are aligned with its culture.

The Corporate Governance Code (the CG Code) as published by The Stock Exchange of Hong Kong Limited sets out the principles of good corporate governance and provides two levels of recommendation:

• code provisions, with which issuers are expected to comply, but with which they may choose not to comply, provided they give considered reasons and explanations for non-compliance

• recommended best practices, with which issuers are encouraged to comply, but which are provided for guidance only.

The Company supports the principles-based approach of the CG Code and the flexibility this provides for the adoption of corporate policies and procedures which recognise the individuality of companies. Swire Pacific has adopted its own corporate governance code which is available on its website (www.swirepacific.com). Corporate governance does not stand still; it evolves with the business and operating environment. The Company is always ready to learn and adopt best practices. As part of its commitment to enhance corporate governance standards within the region, Swire Pacific is a member of the Asian Corporate Governance Association.

The Company complied with all the code provisions set out in the CG Code contained in Part 2 of Appendix C1 to the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited (the Listing Rules) throughout the year covered by the annual report.

Note: The Risk and Finance Committees report to the Board through the Audit Committee.

The Company is governed by a Board of Directors, which has responsibility for strategic leadership and control of the Group designed to maximise shareholder value, while taking due account of the interests of those with whom the Group does business and others.

Responsibility for achieving the Company’s objectives and running the business on a day-to-day basis is delegated to divisional management. The Board exercises a number of reserved powers which include:

• maintaining and promoting the culture of the Company

• formulation of long-term strategy

• approving public announcements, including financial statements

• committing to major acquisitions, divestments and capital projects

• authorising significant changes to the capital structure and material borrowings

• any issue, or buy-back, of equity securities under the relevant general mandates

• approving treasury policy

• setting dividend policy

• approving appointments to the Board

• ensuring that appropriate management development and succession plans are in place

• setting the Group remuneration policy

• approving annual budgets and forecasts

• reviewing operational and financial performance

• reviewing the effectiveness of the Group’s risk management and internal control systems

• ensuring the adequacy of the resources, staff qualifications and experience, training programmes and budget of the Company’s accounting, internal audit, financial reporting and environmental, social and governance (ESG) functions

• overseeing sustainable development matters.

To assist it in fulfilling its duties, the Board has three primary committees, the Audit Committee, the Nomination Committee and the Remuneration Committee.

The CG Code requires that the roles of Chairman and Chief Executive be separate and not performed by the same individual to ensure there is a clear division of responsibilities between the running of the Board and the executives who run the business.

Guy Bradley, the Chairman, is responsible for:

• leadership of the Board

• setting its agenda and taking into account any matters proposed by other Directors for inclusion in the agenda

• facilitating effective contributions from and dialogue with all Directors and constructive relations between them

• ensuring that all Directors are properly briefed on issues arising at Board meetings and that they receive accurate, timely and clear information

• obtaining consensus amongst the Directors

• ensuring, through the Board, that good corporate governance practices and procedures are followed.

Each division of the Group has one or more executive directors who are responsible for implementing the policies and strategies set by the Board in order to ensure the successful day-to-day management of the Group’s individual businesses (see page 103).

Throughout the year, there was a clear division of responsibilities between the Chairman and the respective Chief Executives responsible for the divisions of the Group.

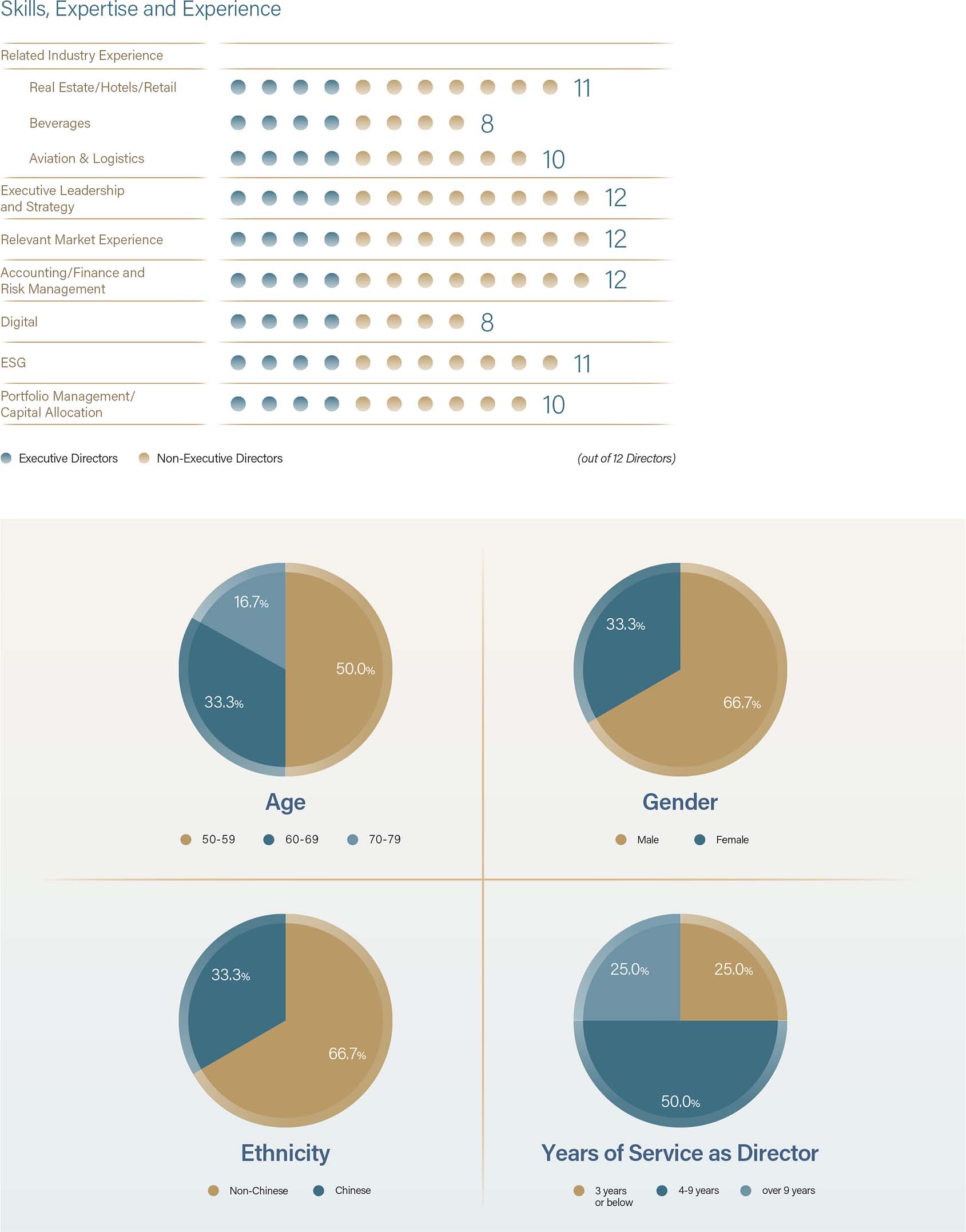

The Board is structured with a view to ensuring it is of a high calibre and has a balance of skills, experience and diversity of perspectives appropriate to the Company’s business so that it works effectively as a team, and that individuals or groups do not dominate any decision-making.

The Board comprises the Chairman, three other Executive Directors and eight Non-Executive Directors. Their biographical details are set out in the section of this annual report headed Directors and Officers and are posted on the Company’s website.

Guy Bradley, David Cogman, Patrick Healy and Martin Murray are directors and/or employees of the John Swire & Sons Limited (Swire) group. Gordon McCallum and Merlin Swire are shareholders, directors and employees of the Swire group. Before he ceased to be a Director of the Company, Zhang Zhuo Ping was a director and an employee of the Swire group.

The Non-Executive Directors bring independent advice, judgement and, through constructive challenge, scrutiny of executives and review of performance and risks. The Audit, Nomination and Remuneration Committees of the Board comprise only Non-Executive Directors.

Six of the eight Non-Executive Directors are Independent Non-Executive Directors, which represent at least one-third of the Board of Directors.

The Independent Non-Executive Directors:

• provide open and objective challenge to management and other Board members

• raise intelligent questions and challenge constructively and with vigour

• bring outside knowledge of the businesses and markets in which the Group operates, providing informed insight and responses to management.

The Company has in place effective mechanisms to ensure that independent views and input are available to the Board. The Nomination Committee, a majority of which is comprised of Independent Non-Executive Directors, assesses the suitability and independence of potential candidates to be appointed as Independent Non-Executive Directors and reviews the independence of each Independent Non-Executive Director annually. The Independent Non-Executive Directors meet with the Chairman at least once annually without the presence of other Directors and they can interact with management and other Directors including the Chairman through formal and informal means. Independent professional advice is also available to all Directors whenever necessary. A review of these mechanisms is conducted on an annual basis to ensure their effectiveness.

Confirmation has been received from all Independent Non-Executive Directors that they are independent as regards the factors set out in Rule 3.13 of the Listing Rules. None of them holds cross-directorships or has significant links with other Directors through involvements in other companies or bodies. The Board considers that all of the Independent Non-Executive Directors are independent in character and judgement.

Rose Lee and Gordon Orr have served as Independent Non-Executive Directors for more than nine years. The Directors are of the opinion that they remain independent, notwithstanding their length of tenure. Rose Lee and Gordon Orr continue to demonstrate the attributes of an Independent Non-Executive Director noted above and there is no evidence that their tenure has had any impact on their independence. During their tenure, Rose Lee and Gordon Orr were not involved in the daily management of the Company nor in any relationship or circumstances which would materially interfere with their exercise of independent judgement. Rose Lee has not held any interests in the shares of the Company and Gordon Orr holds not more than 1% of the number of issued shares of the Company. They have demonstrated strong independence by providing impartial views and exercising independent judgment at Board and Board committee meetings. Drawing upon experience and skills acquired through their other directorships and offices, they are also capable of bringing fresh and objective perspectives to the Board. The Board believes that their detailed knowledge of the Group’s business and their external experience continue to be of significant benefit to the Company, and that they maintain an independent view of its affairs.

Taking into account all of the circumstances described in this section, the Company considers all of the Independent Non-Executive Directors to be independent as regards the factors set out in Rule 3.13 of the Listing Rules.

On appointment, the Directors receive information about the Group including:

• the role of the Board and the matters reserved for its attention

• the role and terms of reference of Board committees

• the Group’s corporate governance practices and procedures

• the powers delegated to management

• the latest financial information.

Directors update their skills, knowledge and understanding of the Company’s businesses through their participation at meetings of the Board and its committees and through regular meetings with management at the head office and in the divisions. Directors are regularly updated by the Company Secretary on their legal and other duties as Directors of a listed company.

Through the Company Secretary, Directors are able to obtain appropriate professional training and advice.

Each Director ensures that he/she can give sufficient time and attention to the affairs of the Group. All Directors disclose to the Board on their first appointment their interests as a Director or otherwise in other companies or organisations and such declarations of interests are updated regularly. No Director was a director of more than five listed companies at 31st December 2024.

Details of Directors' other appointments are shown in their biographies in the section of this annual report headed Directors and Officers.

All committees of the Board follow the same processes as the full Board.

The dates of the 2024 Board meetings were determined in 2023 and any amendments to this schedule were notified to Directors at least 14 days before regular meetings. Appropriate arrangements are in place to allow Directors to include items in the agenda for regular Board meetings.

Agendas and accompanying Board papers are circulated with sufficient time to allow the Directors to prepare before meetings.

The Chairman takes the lead to ensure that the Board acts in the best interests of the Company, that there is effective communication with the shareholders and that their views are communicated to the Board as a whole.

Board decisions are made by vote at Board meetings and supplemented by the circulation of written resolutions between Board meetings.

Minutes of Board meetings are taken by the Company Secretary and, together with any supporting papers, are made available to all Directors. The minutes record the matters considered by the Board, the decisions reached, and any concerns raised or dissenting views expressed by Directors. Draft and final versions of the minutes are sent to all Directors for their comment and records respectively.

Board meetings are structured so as to encourage open discussion, frank debate and active participation by Directors in meetings.

Directors meet at least once annually to discuss the Company’s strategy, including investment and divestment plans and other strategic initiatives. The strategy session also serves as a platform for raising new initiatives and ideas.

The Board is provided with such information and explanations as are necessary to enable them to make an informed assessment of the financial and other information put before the Board. Queries raised by Directors are answered fully and promptly.

When necessary, the Independent Non-Executive Directors meet privately to discuss matters which are their specific responsibility. One such meeting was held in 2024.

The Chairman meets at least annually with the Independent Non-Executive Directors without the presence of other Directors.

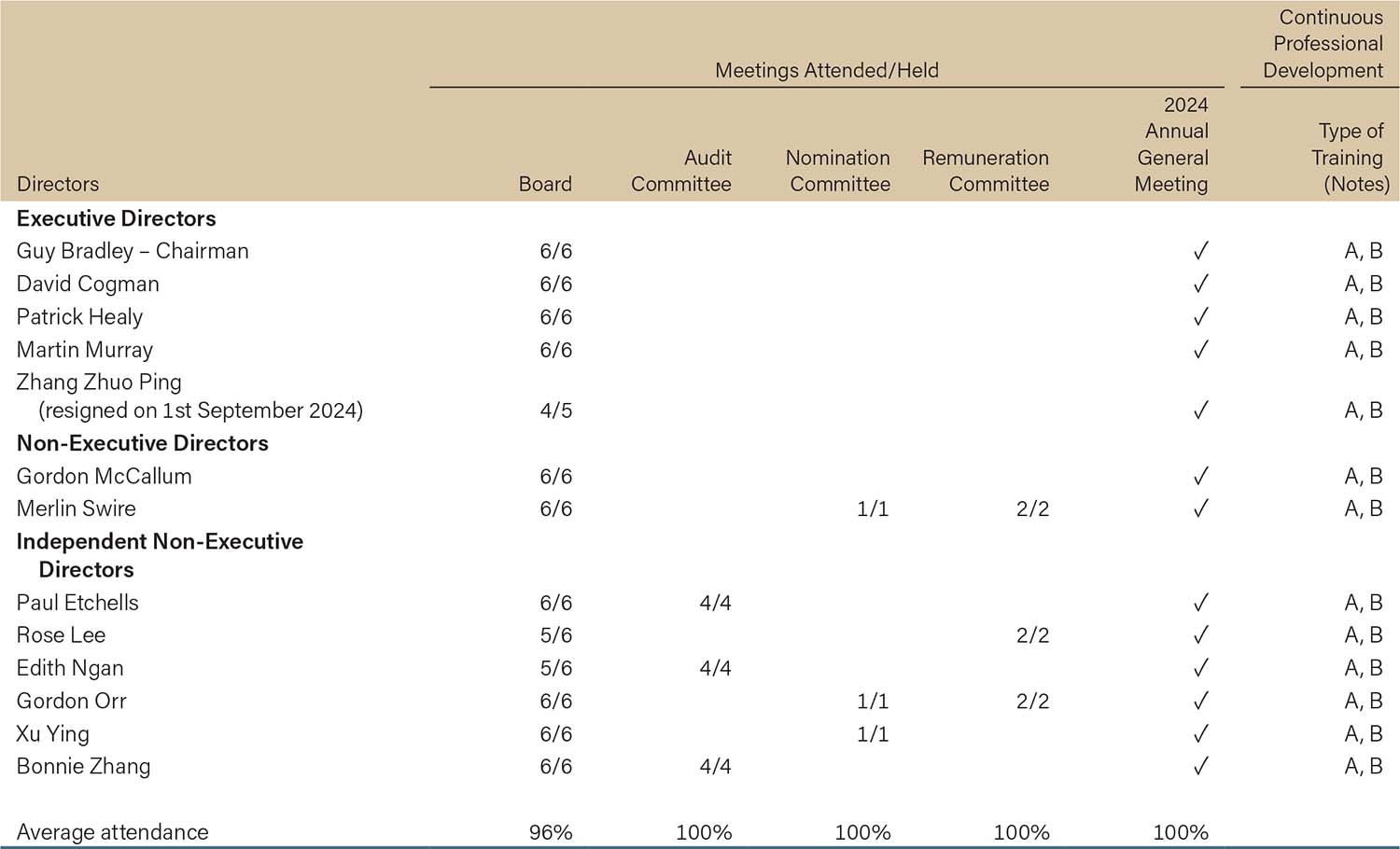

The Board met six times in 2024, including a strategy session. The attendance of individual Directors at meetings of the Board and its committees is set out in the table below. Average attendance at Board meetings was 96%. All Directors attended Board meetings in person or through electronic means of communication during the year.

Notes:

A: Received training materials about matters relevant to their duties as Directors including on ESG.

B: Attended training by external advisers about applicable laws and regulations and topics pertinent to the business of the Company.

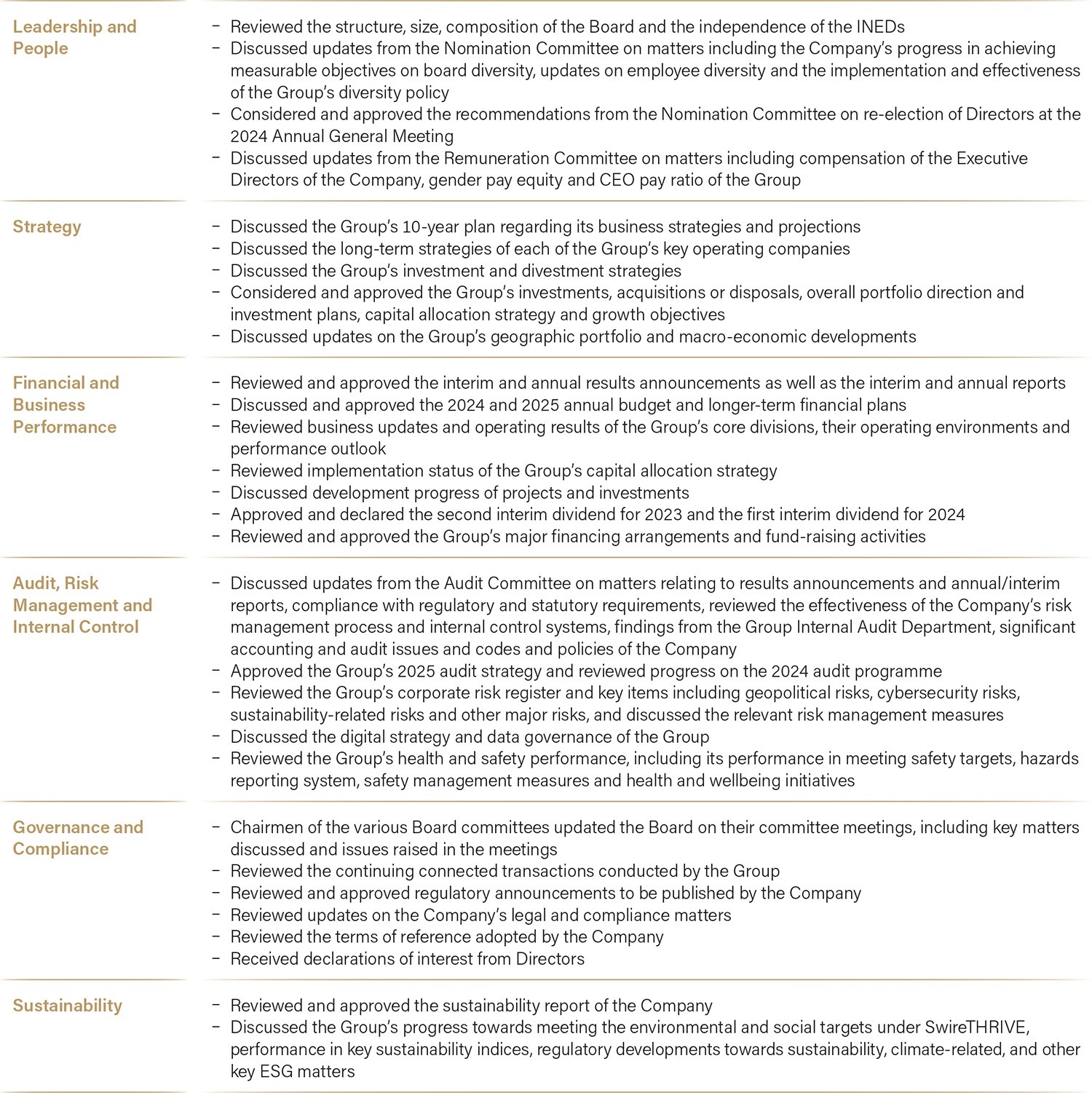

Key areas of the activities of the Board during the year are summarised below.

The Company makes available continuous professional development for all Directors at the expense of the Company so as to develop and refresh their knowledge and skills.

All Directors have been provided with “A Guide on Directors’ Duties” issued by the Companies Registry, “Guidelines for Directors” issued by the Hong Kong Institute of Directors and “Corporate Governance Guide for Boards and Directors” issued by The Stock Exchange of Hong Kong Limited and other training materials on various topics, including ESG matters and regulatory updates issued by The Stock Exchange of Hong Kong Limited or external advisers. They were invited to attend seminars and conferences about financial, commercial, economic, risk management, legal, regulatory and other business matters.

The Company has arranged appropriate insurance cover in respect of potential legal actions against its Directors and Officers.

If a Director has a material conflict of interest in relation to a transaction or proposal to be considered by the Board, the individual is required to declare such interest and abstains from voting. The matter is considered at a Board meeting and voted on by Directors who have no material interest in the transaction.

Responsibility for delivering the Company’s strategies and objectives, as established by the Board, and responsibility for day-to-day management is delegated to the head of each business unit. These individuals have been given clear guidelines and directions as to their powers and, in particular, the circumstances under which they should report back to, and obtain prior approval from, the Board before making commitments on behalf of the Company.

The Board monitors management’s performance against the achievement of financial and non-financial measures, the principal items monitored being:

• detailed monthly reports dealing with health and safety (and other ESG matters), profit performance, capital allocation, credit metrics and portfolio strategy

• internal and external audit reports

• feedback from customers, others with whom the Group does business, trade associations and service providers.

The Company has adopted a code of conduct (the Securities Code) regarding securities transactions by Directors on terms no less exacting than the required standard set out in the Model Code for Securities Transactions by Directors of Listed Issuers (the Model Code) contained in Appendix C3 to the Listing Rules. These rules are available on the Company’s website.

A copy of the Securities Code has been sent to each Director of the Company and is sent to each Director twice annually, immediately before the two financial period ends, with a reminder that the Director cannot deal in the securities and derivatives of the Company during the blackout period before the Group’s interim and annual results have been published, and that all their dealings must be conducted in accordance with the Securities Code.

Under the Securities Code, Directors are required to notify the Chairman and receive a dated written acknowledgement before dealing in the securities and derivatives of the Company and, in the case of the Chairman himself, he must notify the Chairman of the Audit Committee and receive a dated written acknowledgement before any dealing.

On specific enquiries made, all the Directors of the Company have confirmed that they have complied with the required standard set out in the Model Code and the Securities Code.

Directors’ interests at 31st December 2024 in the shares of the Company and its associated corporations (within the meaning of Part XV of the Securities and Futures Ordinance) are set out in the section of this annual report headed Directors' Report.

Potential new Directors are identified and considered by the Nomination Committee for appointment by the Board. A Director appointed by the Board is subject to election by shareholders at the first annual general meeting after his or her appointment, and all Directors are subject to re-election by shareholders every three years.

Potential new Board members are identified on the basis of skills, knowledge and experience which, on assessment by the Directors, will enable them to make a positive contribution to the diversity and performance of the Board. The Company reviews the composition of the Board on a continuing basis by keeping track of the tenure of Directors and the need for new Directors to be appointed and maintaining a pipeline of candidates comprising internal and external candidates as may be identified from time to time. Executive search agencies may be engaged as appropriate to identify external candidates with the desirable skillsets. The composition of the Board includes directors who are appointed as Independent Non-Executive Directors, nomination from substantial shareholder and executives of the Company.

In assessing the suitability of a proposed candidate (including Directors eligible for election or re-election), the following non-exhaustive list of factors will be considered:

• the corporate strategy of the Company

• the structure, size, composition and needs of the Board

• the potential contributions a candidate can bring to the Board, including the desirable skillsets, experience and other attributes that are complementary to the Board

• the qualifications, integrity and expected time commitment of the candidate

• various aspects of diversity (including gender, age, cultural and educational background, and ethnicity) with reference to the Board Diversity Policy of the Company

• the independence of a candidate to be appointed as an Independent Non-Executive Director.

On 11th March 2025, the Nomination Committee, having reviewed the Board’s composition and after taking into account the requirement that all Directors are subject to election or re-election (as the case may be) in accordance with the Company’s Articles of Association, nominated Guy Bradley, Patrick Healy, Gordon Orr and Xu Ying for recommendation to shareholders for re-election at the 2025 Annual General Meeting. Rose Lee also retires this year but does not offer herself for re-election. The nominations were made in accordance with objective criteria (including gender, age, cultural and educational background, ethnicity, professional experience, skills, knowledge, length of service, number of directorships of listed companies and the legitimate interests of the Company’s principal shareholders), with due regard for the benefits of diversity, as set out in the Board Diversity Policy. The Nomination Committee is satisfied with the independence of Gordon Orr and Xu Ying having regard to the criteria set out in the Listing Rules. On 13th March 2025, the Board, having considered the recommendation of the Nomination Committee and having taken into account the respective contributions of Guy Bradley, Patrick Healy, Gordon Orr and Xu Ying to the Board and their firm commitment to their roles, recommended all of them for re-election at the 2025 Annual General Meeting. The particulars of the Directors standing for re-election are set out in the section of this annual report headed Directors and Officers and will also be set out in the circular to shareholders to be distributed with this annual report and posted on the Company’s website.

Full details of changes in the Board during the year and to the date of this report are provided in the section of this annual report headed Directors' Report.

The Board has adopted a Board Diversity Policy, which is available on the Company’s website. Responsibility for the implementation, monitoring and annual review of this policy has been delegated to the Nomination Committee.

The Board’s composition reflects a balance of skills, experience and diversity of perspectives among its members that are relevant to the Company’s strategy, governance and business and contributes to the Board’s effectiveness.

In order to achieve a diversity of perspectives among members of the Board, it is the policy of the Company to consider a number of factors when deciding on appointments to the Board and the continuation of those appointments. Such factors include gender, age, cultural and educational background, ethnicity, professional experience, skills, knowledge, length of service and the legitimate interests of the Company’s principal shareholders.

The Company has achieved its target of having female Board members account for 30% of total Board members by 2024. Following the Board change in September 2024, female representation on the Board is now 33.3%. The Company aims to maintain not less than 30% of female members on the Board on average over any three-year cycle.

The female representation in the workforce at 31st December 2024 was 32.4% (excluding Cathay group and Hong Kong Aero Engine Services Limited). Details of gender diversity in the workforce are disclosed in the section of this annual report headed Sustainability Review, and in the 2024 Sustainability Report of the Company.

The Company has adopted the following measures to develop a pipeline of potential successors to the Board:

• the Company keeps track of the tenure of Directors and the need for new or replacement directors to be appointed (as the case may be), and maintains a running list of candidates comprising internal and external candidates as may be identified from time to time

• principles and key criteria for evaluating candidates for directorship are set out in the Nomination Committee’s terms of reference and the Company’s Board Diversity Policy

• the skills and experience of existing Directors help set the criteria for internal and external candidate search

• executive search agencies may be engaged as appropriate to identify external candidates with desirable skillsets.

The Nomination Committee consists of three Non-Executive Directors, Gordon Orr, Merlin Swire and Xu Ying. Two of the Committee members are Independent Non-Executive Directors, one of whom, Gordon Orr, is Chairman. All the members served for the whole of 2024.

The terms of reference of the Nomination Committee comply with the CG Code and are posted on the Company’s website.

The Nomination Committee’s duties include:

• to review the structure, size and composition (including the skills, knowledge and experience) of the Board at least annually and make recommendations on any proposed changes to the Board to complement the Company’s corporate strategy

• to identify individuals suitably qualified to become board members and select or make recommendations to the Board on the selection of individuals nominated for directorship

• to assess the independence of the Independent Non-Executive Directors

• to make recommendations to the Board on the appointment or re-appointment of Directors and succession planning for Directors, in particular the Chairman

• to review the implementation and effectiveness of the Company’s policy on board diversity on an annual basis.

The Nomination Committee met once in 2024. A summary of its work is as follows:

• conducted (i) an annual review of the structure, size and composition (including the skills, knowledge and experience) of the Board and considered that the Board’s composition reflects an appropriate mix of skills, experience and diversity among its members that are relevant to the Company’s strategy, governance and business and contributes to the Board’s effectiveness; (ii) an annual assessment of the independence of each Independent Non-Executive Director and considered all of the Independent Non-Executive Directors to be independent; and (iii) an annual review of the implementation and effectiveness of the Company’s Board Diversity Policy and considered it to be appropriate

• reviewed the Board’s target of maintaining not less than 30%of female Board members and considered it to be appropriate

• made recommendations to the Board in respect of the proposed re-election of the Directors retiring at the 2024 Annual General Meeting.

The Nomination Committee assessed the Board’s diversity by reviewing a comparison against industry and peer group companies, and the relevant experience and skillsets of the Directors. The Committee considered that:

• the ratios for the objective criteria (e.g. age, gender and ethnicity) amongst Board members were reasonable

• the Company was in a good position in terms of gender diversity compared with its peers

• the Board shall maintain not less than 30% of female members on the Board.

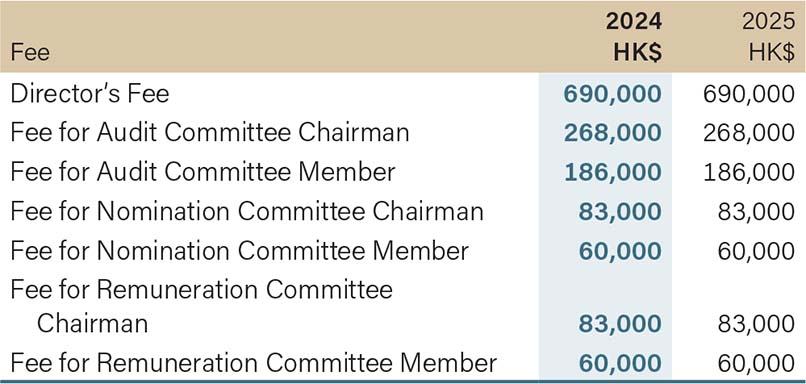

Full details of the remuneration of the Directors are provided in note 8 to the financial statements.

The Remuneration Committee comprises three Non-Executive Directors, Gordon Orr, Rose Lee and Merlin Swire. Two of the Committee members are Independent Non-Executive Directors, one of whom, Gordon Orr, is Chairman. All the members served for the whole of 2024.

The terms of reference of the Remuneration Committee have been reviewed with reference to the CG Code and are posted on the Company’s website.

The Remuneration Committee reviews and approves the remuneration proposals with respect to the Executive Directors of the Company, with reference to the Company’s Remuneration Policy and the Board’s corporate goals and objectives.

The Remuneration Committee exercises the powers of the Board to determine the remuneration packages of individual Executive Directors (including salaries, bonuses, benefits in kind and the terms on which they participate in any provident fund or other retirement benefit scheme), taking into consideration salaries paid by comparable companies, time commitments and responsibilities and employment conditions elsewhere in the Group.

In order to be able to attract and retain employees with the appropriate skills, experience and of suitable calibre, the Swire group provides a competitive remuneration package designed to be commensurate, overall, with those of its peer group. This typically comprises salary, housing, retirement benefits, allowances, medical benefits and a discretionary bonus related to the overall profit of the Swire Pacific group. Although the remuneration for Executive Directors is not entirely linked to the profits of the business in which they are working, it is considered that, given the different profitability of businesses within the Group, these arrangements have contributed considerably to the maintenance of a flexible, motivated and high-calibre management team within the Group.

The Remuneration Committee reviewed the structure and levels of remuneration paid to Executive Directors at its meeting in October 2024. At this meeting, the Committee considered a report prepared for it by Mercer Limited, an independent firm of consultants, which confirmed that the remuneration of the Company’s Executive Directors was competitive with that paid to equivalent positions in peer group companies.

No Director takes part in the determination of his or her own remuneration.

The following fee levels have been approved by the Board:

Details of emoluments paid to each Director in 2024 are set out in note 8 to the financial statements.

The Board acknowledges its responsibility for:

• the proper stewardship of the Company’s affairs, to ensure the integrity of financial information

• preparing annual and interim financial statements and other related information that give a true and fair view of the Group’s affairs and of its results and cash flows for the relevant periods, in accordance with Hong Kong Financial Reporting Standards and the Hong Kong Companies Ordinance

• selecting appropriate accounting policies and ensuring that these are consistently applied

• making judgements and estimates that are prudent and reasonable

• ensuring that the application of the going concern assumption is appropriate.

The Board acknowledges its responsibility to establish, maintain and review the effectiveness of the Group’s risk management and internal control systems. This responsibility is primarily fulfilled on its behalf by the Audit Committee.

The foundation of strong risk management and internal control systems is dependent on the ethics and culture of the organisation, the quality and competence of its personnel, the direction provided by the Board, and the effectiveness of management.

Since profits are, in part, the reward for successful risk taking in business, the risk management and internal control systems are designed to manage rather than eliminate the risk of failure to achieve business objectives and can only provide reasonable and not absolute assurance against material misstatement or loss.

The key components of the Group’s control structure are as follows:

Culture: The Board believes that good corporate governance reflects the culture of an organisation. This is more significant than any written procedures.

The Company aims at all times to act ethically and with integrity, and to instill this behaviour in all its employees by example from the Board down. The Company has a Corporate Code of Conduct, which is posted on its website.

The Company is committed to developing and maintaining high professional and ethical standards. These are reflected in the rigorous selection process and career development plans for all employees. The organisation prides itself on being a long-term employer which instills in individuals, as they progress through the Group, a thorough understanding of the Company’s ways of thinking and acting.

Channels of communication are clearly established, allowing employees a means of communicating their views upwards with a willingness on the part of more senior personnel to listen. Employees are aware that, whenever the unexpected occurs, attention should be given not only to the event itself, but also to determining the cause.

Through the Company’s Corporate Code of Conduct, employees are encouraged (and instructed as to how) to report control deficiencies or suspicions of impropriety to those who are in a position to take necessary action. The Company has a Whistleblowing Policy and system for employees and those who deal with the Group to raise concerns, in confidence and with anonymity, where desired, about actual or suspected cases of impropriety in any matter related to the Group. The policy is available on the Company’s website.

The Company has an Anti-Bribery and Corruption Policy which sets out the Company’s policy and systems that promote and support compliance with applicable anti-bribery and corruption laws and regulations, and enhances the provisions relating to bribery and corruption in the Company’s Corporate Code of Conduct. The policy is available on the Company’s website.

Risk assessment: The Board of Directors and the management each have a responsibility to identify and analyse the risks underlying the achievement of business objectives, and to determine how such risks should be managed and mitigated.

The Board has adopted the three lines of defence model of risk governance. The first line manages risks. The second line oversees the management of risks. The third line assesses the effectiveness of risk controls. The model is designed to ensure that the Board has assurance as to the effectiveness of risk management in the Group’s businesses and that conflicts of interest are minimised.

The first line of defence is the executive management of the operating companies, with input from specialist committees comprised of subject matter experts from within the Group. The Finance Committee sets policies for the management of financial risks (for example interest rate, foreign exchange, liquidity and credit risks), implements the policy (by, for example, hedging) and monitors the financial exposure of the Company and the operating companies.

The second line of defence consists of (i) the Group Risk Management Committee (GRMC) (supported by risk forums dealing with IT, data and technology risks; ESG risks; human resources, health and safety risks and government, regulatory and legal risks) and (ii) risk officers and risk committees and other bodies responsible for risk in operating companies. The Company also has a Risk Committee (in addition to GRMC) which considers the risks relating to the Company itself.

The third line of defence is provided by the Group Internal Audit Department (GIAD).

The Finance Committee, GRMC and GIAD report to the Board through the Audit Committee.

The senior officer responsible for the management of risk in the Company is the Finance Director, who chairs GRMC, the Company’s Risk Committee and the Finance Committee. For further information about these committees, see the Risk Management section of this report.

Management structure: The Group has a clear organisational structure that, to the extent required, delegates the day-to-day responsibility for the design, documentation and implementation of procedures and monitoring of risk. Individuals appreciate where they will be held accountable in this process.

A control self-assessment process requires the management in each material business unit to assess, through the use of detailed questionnaires, the adequacy and effectiveness of risk management and internal controls over the reliability of financial reporting, the effectiveness and efficiency of operations and compliance with applicable laws and regulations. This process and its results are reviewed by internal auditors and form part of the Audit Committee’s annual assessment of control effectiveness.

Controls and review: The control environment comprises policies and procedures intended to ensure that relevant management directives are carried out and actions that may be needed to address risks are taken. These may include approvals and verifications, reviews, safeguarding of assets and segregation of duties. Control activities can be divided into operations, financial reporting and compliance, although there may, on occasion, be some overlap between them. The typical control activities adopted by Group companies include:

• analytical reviews: for example, conducting reviews of actual performance versus budgets, forecasts, prior periods and competitors

• direct functional or activity management: reviews of performance reports, conducted by managers in charge of functions or activities

• information-processing: performing controls intended to check the authorisation of transactions and the accuracy and completeness of their reporting, for example exception reports

• physical controls: ensuring equipment, inventories, securities and other assets are safeguarded and subjected to periodic checks

• performance indicators: carrying out analyses of different sets of data, operational and financial, examining the relationships between them and taking corrective action where necessary

• segregation of duties: dividing and segregating duties among different people, with a view to strengthening checks and minimising the risk of errors and abuse.

The Company has in place effective processes and systems for the identification, capture and reporting of operational, financial and compliance-related information in a form and time frame intended to ensure that staff carry out their designated responsibilities.

Internal audit: Independent of management, GIAD reports directly to the Audit Committee and performs regular reviews of key risk areas and monitors compliance with Group accounting, financial and operational procedures. The role of GIAD is discussed further here.

The Audit Committee, consisting of three Independent Non-Executive Directors, Paul Etchells, Edith Ngan and Bonnie Zhang, assists the Board in discharging its responsibilities for corporate governance and financial reporting. Paul Etchells is the Chairman of the Audit Committee. All the members served for the whole of 2024.

The terms of reference of the Audit Committee follow the guidelines set out by the Hong Kong Institute of Certified Public Accountants and comply with the CG Code. They are available on the Company’s website.

The Audit Committee met four times in 2024. Regular attendees at the meetings are the Finance Director, the Group Head of Internal Audit, the external auditors, the General Manager of Group Finance, the Chief Risk Officer, the Chief Information Security Officer and the Group Head of Sustainability. The Audit Committee meets at least twice a year with the external auditors, and at least once a year with the Group Head of Internal Audit, in each case without the presence of management. Each meeting receives written reports from GRMC, the external auditors and GIAD.

The work of the Committee during 2024 included reviews of the following matters:

• the completeness, accuracy and integrity of formal announcements relating to the Group’s performance including the 2023 annual and 2024 interim reports and announcements, with recommendations to the Board for approval

• the Group’s compliance with regulatory and statutory requirements

• the Group’s risk management and internal control systems

• the Group’s risk management processes

• the Group’s cybersecurity

• the approval of the 2025 annual internal audit programme and review of progress on the 2024 programme

• periodic reports from GIAD and progress in resolving any matters identified in them

• significant accounting and audit issues

• the Company’s policy regarding connected transactions and the nature of such transactions

• the relationship with the external auditors as discussed on here

• external quality assessment of GIAD

• the Company’s compliance with the CG Code

• the Company’s policies.

In 2025, the Committee has reviewed, and recommended to the Board for approval, the 2024 financial statements.

Assessing the Effectiveness of Risk Management and Internal Control Systems

On behalf of the Board, the Audit Committee reviews annually the continued effectiveness of the Group’s risk management and internal control systems dealing with risk and financial accounting and reporting, the effectiveness and efficiency of operations, compliance with laws and regulations, and risk management functions.

This assessment considers:

• the scope and quality of management’s ongoing monitoring of risks (including ESG risks) and of the risk management and internal control systems, the work and effectiveness of internal audit and the assurances provided by the Finance Director

• the changes in the nature and extent of significant risks (including ESG risks) since the previous review and the Group’s ability to respond to changes in its business and the external environment

• the extent and frequency with which the results of monitoring are communicated, enabling the Committee to build up a cumulative assessment of the state of control in the Group and the effectiveness with which risk is being managed

• the incidence of any significant control failings or weaknesses that have been identified at any time during the period and the extent to which they have resulted in unforeseen outcomes or contingencies that have had, could have had, or may in the future have, a material impact on the Company’s financial performance or condition

• the effectiveness of the Company’s processes in relation to financial reporting and statutory and regulatory compliance

• areas of risk identified by management

• significant risks reported by GIAD and GRMC

• work programmes proposed by GIAD and the external auditors

• significant issues arising from internal and external audit reports

• the results of management’s control self-assessment exercise.

As a result of the above review, the Board confirms, and management has also confirmed to the Board, that the Group’s risk management and internal control systems are effective and adequate and have complied with the CG Code provisions on risk management and internal control throughout the year and up to the date of this annual report.

The Company Secretary is an employee of the Company and is appointed by the Board. The Company Secretary is responsible for facilitating the Board’s processes and communications among Board members, with shareholders and with management. The Company Secretary undertakes at least 15 hours of relevant professional training annually to update skills and knowledge.

The Swire group has had GIAD in place for 29 years. GIAD plays a critical role in monitoring the governance of the Group. The department is staffed by 29 audit professionals and conducts audits of the Group and of other companies in the Swire group. The 29 professionals include a team based in the Chinese Mainland which reports to the Group Head of Internal Audit in Hong Kong.

GIAD reports directly to the Audit Committee without the need to consult with management, and via the Audit Committee to the Board. GIAD has unrestricted access to all areas of the Group’s business units, assets, records and personnel in the course of conducting its work.

The annual internal audit programme and resources are reviewed and agreed with the Audit Committee.

Scope of Work

Business unit audits are designed to provide assurance that the risk management and internal control systems of the Company are implemented properly and operating effectively, and that the risks associated with the achievement of business objectives are being properly identified, monitored and managed.

The frequency of each audit is determined by GIAD using its own risk assessment methodology, which is based on the COSO (Committee of Sponsoring Organizations of the Treadway Commission) internal control framework, considering such factors as recognised risks, organisational change, overall materiality of each unit, previous internal audit results, external auditors’ comments, output from the work of GRMC and management’s views. Each business unit is typically audited at least once every three years. Acquired businesses would normally be audited within 12 months. 34 assignments were conducted for Swire Pacific in 2024.

In addition, GIAD assists the Audit Committee in carrying out the analysis and independent appraisal of the adequacy and effectiveness of the Group’s risk management and internal control systems through its review of the process by which management has completed the annual control self-assessment, and the results of this assessment.

Furthermore, GIAD conducts ad-hoc projects and investigative work as may be required by management or the Audit Committee.

Audit Conclusion and Response

Copies of internal audit reports are sent to the Chairman of the Board, the Finance Director and the external auditors. The results of each review are also presented to the Audit Committee. Management is required to provide action plans in response to internal audit recommendations, including those aimed at resolving material internal control defects. These are agreed by GIAD, included in its reports and followed up with a view to ensuring that they are satisfactorily undertaken.

The Audit Committee acts as a point of contact, independent from management, with the external auditors (the auditors). The auditors, PricewaterhouseCoopers, have direct access to the Chairman of the Audit Committee, who meets with them periodically without management present.

The Audit Committee’s duties in relation to the auditors include:

• recommending to the Board, for approval by shareholders, the auditors’ appointment

• approval of the auditors’ terms of engagement

• consideration of the letters of representation to be provided to the auditors in respect of the interim and annual financial statements

• review of reports and other ad-hoc papers from the auditors

• annual appraisal of the quality and effectiveness of the auditors

• assessment of the auditors’ independence and objectivity, including the monitoring of non-audit services provided, with a view to ensuring that their independence and objectivity are not, and are not seen to be, compromised

• approval of audit and non-audit fees.

Auditors' Independence

Independence of the auditors is of critical importance to the Audit Committee, the Board and shareholders. The auditors write annually to the members of the Audit Committee confirming that they are independent accountants in accordance with the Code of Ethics for Professional Accountants of the Hong Kong Institute of Certified Public Accountants and that they are not aware of any matters which may reasonably be thought to bear on their independence. The Audit Committee assesses the independence of the auditors by considering and discussing each such letter (and having regard to the fees payable to the auditors for audit and non-audit work and the nature of the non-audit work) at a meeting of the Audit Committee.

Provision of Non-audit Services

In deciding whether the auditors should provide non-audit services the following key principles are considered:

• the auditors should not audit their own firm’s work

• the auditors should not make management decisions

• the auditors’ independence should not be impaired

• quality of service.

In addition, the Company has a protocol in place for approval of the provision of non-audit services by the auditors. Any services which may be considered to be in conflict with the role of the auditors must be submitted to the Audit Committee for approval prior to engagement, regardless of the amounts involved. The protocol is updated from time to time to ensure compliance.

The fees in respect of audit and non-audit services provided to the Group by the auditors for 2024 amounted to approximately HK$61 million and HK$42 million respectively. Fees paid to the auditors are disclosed in note 6 to the financial statements.

With respect to procedures and internal controls for the handling and dissemination of inside information, the Company:

• is required to disclose inside information as soon as reasonably practicable in accordance with the Securities and Futures Ordinance and the Listing Rules

• conducts its affairs with close regard to the “Guidelines on Disclosure of Inside Information” issued by the Securities and Futures Commission

• has included in its Corporate Code of Conduct a strict prohibition on the unauthorised use of confidential or inside information.