Copyright © 2024 Swire Pacific Limited. All rights reserved.

Cathay Pacific today released its traffic figures for August 2021 that continued to reflect the airline's substantial capacity reductions in response to significantly reduced demand as well as travel restrictions and quarantine requirements in place in Hong Kong and other markets amid the ongoing global COVID-19 pandemic.

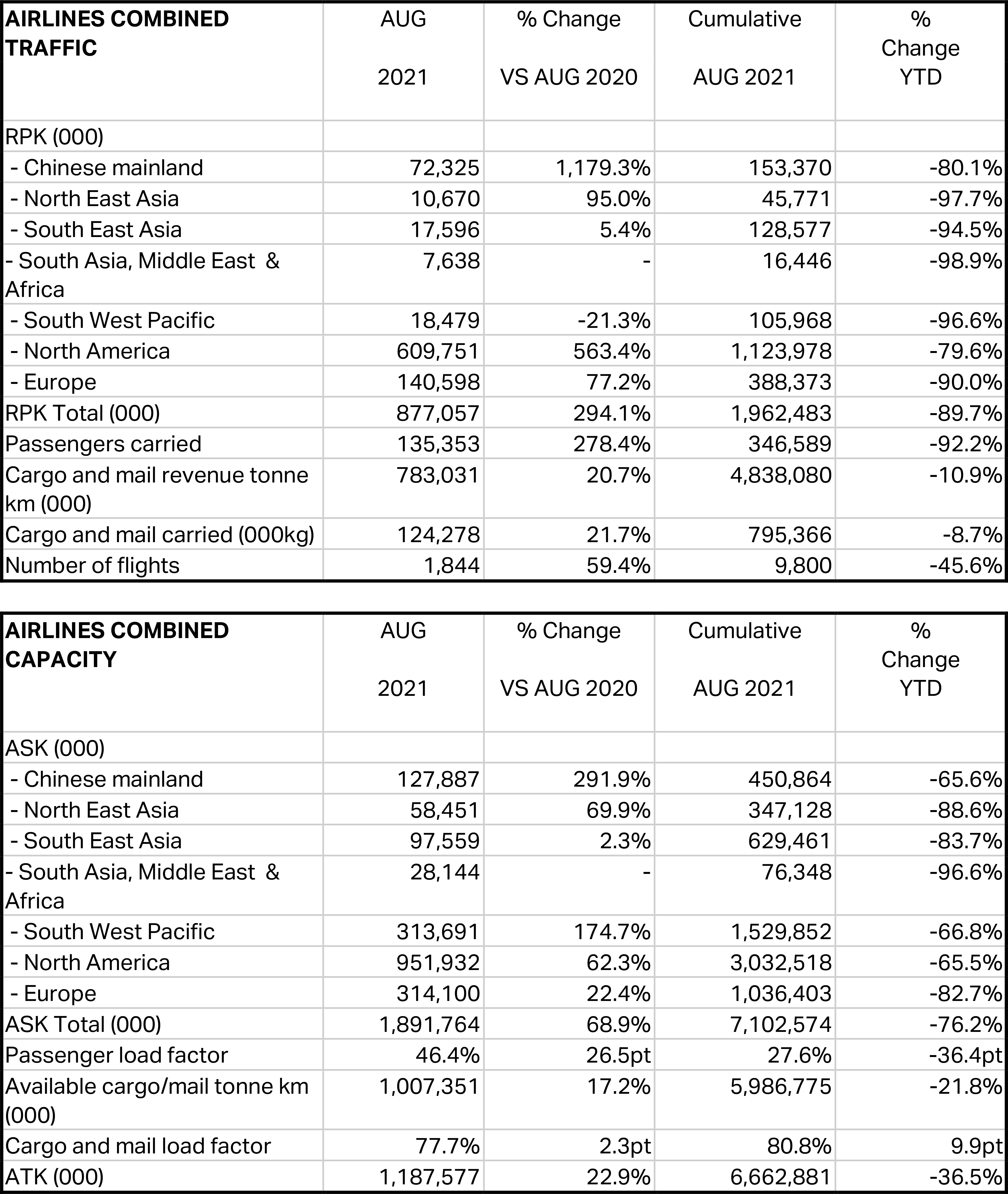

Cathay Pacific carried a total of 135,353 passengers last month, an increase of 278.4% compared to August 2020, but a 95.3% decrease compared to the pre-pandemic level in August 2019. The month's revenue passenger kilometres (RPKs) rose 294.1% year-on-year, but were down 92.4% versus August 2019. Passenger load factor increased by 26.5 percentage points to 46.4%, while capacity, measured in available seat kilometres (ASKs), increased by 68.9%, but remained 86.9% down on August 2019 levels. In the first eight months of 2021, the number of passengers carried dropped by 92.2% against a 76.2% decrease in capacity and an 89.7% decrease in RPKs, as compared to the same period for 2020.

The airline carried 124,278 tonnes of cargo and mail last month, an increase of 21.7% compared to August 2020, but a 23% decrease compared with the same period in 2019. The month's revenue freight tonne kilometres (RFTKs) rose 20.7% year-on-year, but were down 15.4% compared to August 2019. The cargo and mail load factor increased by 2.3 percentage points to 77.7%, while capacity, measured in available freight tonne kilometres (AFTKs), was up by 17.2% year-on-year, but was down 33.8% versus August 2019. In the first eight months of 2021, the tonnage decreased by 8.7% against a 21.8% drop in capacity and a 10.9% decrease in RFTKs, as compared to the same period for 2020.

Outlook

"Our August passenger performance, with capacity at about 13% of pre-pandemic levels, was an improvement over previous months. We had hoped to operate as much as 30% of pre-pandemic capacity by the fourth quarter of 2021. However, operational and passenger travel restrictions remain in place, continuing to constrain our ability to operate more flights. As such, we now only expect to maintain similar passenger capacity levels to August 2021 for the remainder of the year, whilst remaining responsive to any unexpected changes in travel restrictions. We maintain our focus on prudent cash management, targeting cash burn of less than HK$1 billion per month for the rest of 2021.

"For cargo, market indicators suggest a strong peak season driven by the need for inventory replenishment, against a backdrop of ongoing air capacity constraints and disruptions to supply chains due to seaport congestion. We are planning for this, whilst remaining vigilant regarding changes to the COVID-19 situation that could impact operations.

"Despite our short-term challenges, we remain committed to keeping our home city connected to the world via the Hong Kong international aviation and logistics hub."