Copyright © 2024 Swire Pacific Limited. All rights reserved.

Reaching a new passenger milestone while continuing to expand the Group’s global network

The Cathay Group today released its traffic figures for April 2025.

Chief Customer and Commercial Officer Lavinia Lau said: “April was a good month for our travel business. The various holidays in Hong Kong, the Chinese Mainland and elsewhere in Asia helped drive strong leisure travel demand, and over the Easter travel peak we were pleased to once again set a new post-pandemic record with Cathay Pacific and HK Express carrying more than 115,000 passengers combined on 18 April.

“As a Group, we are continuing to add more ports to our extensive passenger network, having launched flights to five new destinations in just April, including Dallas-Fort Worth and Urumqi for Cathay Pacific, and Nha Trang, Ishigaki and Komatsu for HK Express. We remain focused on reaching 100 passenger destinations within the first half of the year, with more passenger destinations to be introduced in the coming weeks and months.

“On the cargo front, the latest announcements regarding the tariffs between China and the United States provide some reassurance to the market in the near term. We will continue to closely monitor the market conditions and leverage our built-in flexibility to adjust freighter capacity.”

Cathay Pacific

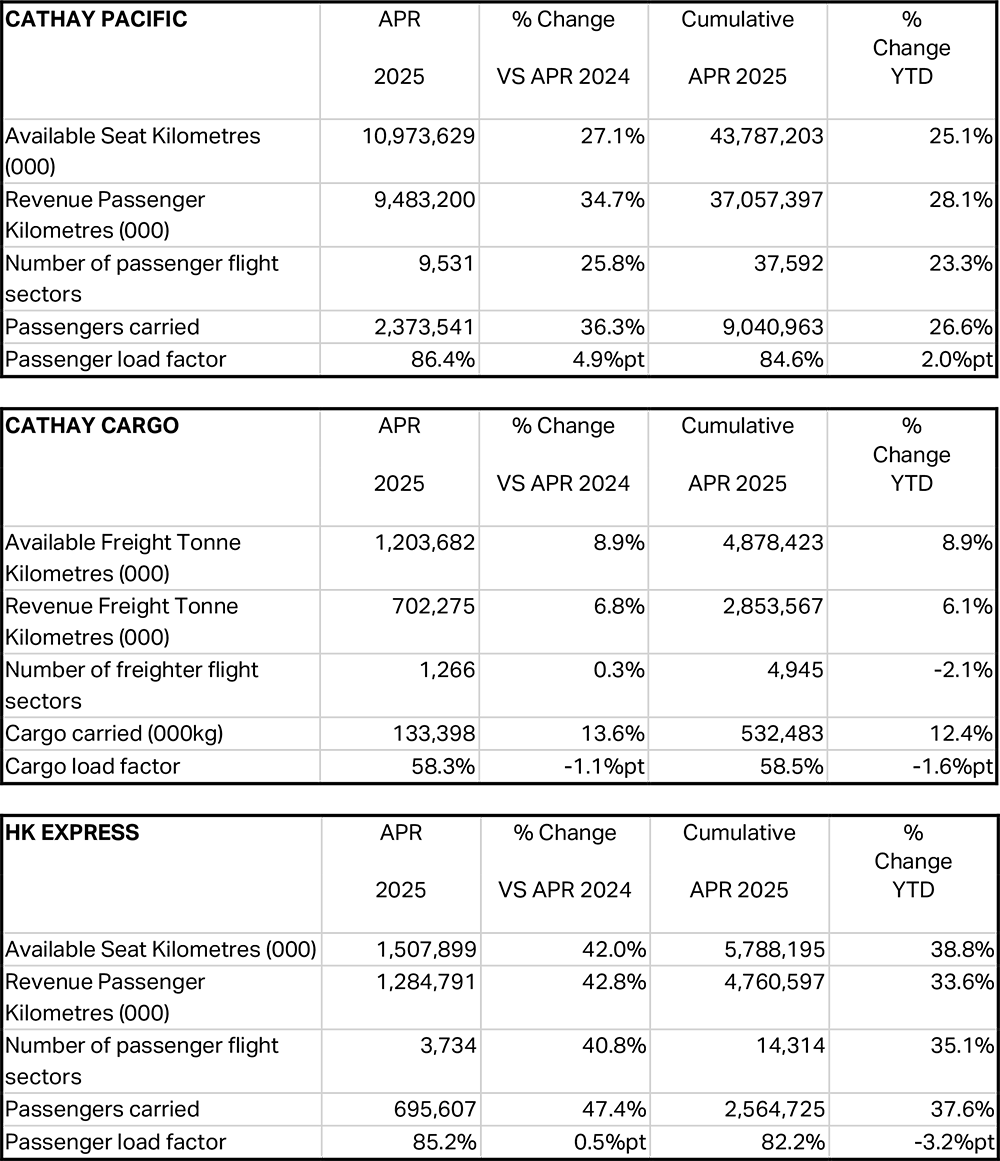

Cathay Pacific carried 36.3% more passengers in April 2025 compared with April 2024, while Available Seat Kilometres (ASKs) increased by 27.1%. In the first four months of 2025, the number of passengers carried increased by 26.6% compared with the same period for 2024.

Lavinia said: “Following a quieter month in March, leisure travel demand experienced a boost in April. The Cathay/HSBC Hong Kong Sevens and the festive period in Indonesia generated strong demand for return traffic early in the month, followed by a notable increase in travel demand over Easter. Then, towards the end of April, we observed robust pre-holiday demand from the Chinese Mainland and Japan, coinciding with the respective ‘Golden Week’ holidays in those two markets.

“Together with our newly launched services to Dallas-Fort Worth and Urumqi, which have been met with enthusiasm, our network achieved a load factor of over 86.4% in April, the highest yet of any month this year. Looking ahead, we are excited to welcome Rome and Munich to our network in June as we continue to add more destinations and flights for our customers.”

Cathay Cargo

Cathay Cargo carried 13.6% more cargo in April 2025 than in April 2024. Available Freight Tonne Kilometres (AFTKs) increased by 8.9% while load factor decreased by 1.1 percentage points year on year. In the first four months of 2025, the total tonnage increased by 12.4% compared with the same period for 2024.

Lavinia said: “Tonnage in April was 10.4% lower than in March, primarily due to the traditional first quarter-end peak in March and the various holiday periods in April. However, our specialist solutions maintained their growth momentum and we saw increased demand for our Cathay Priority solution on the Asia Pacific-United States trade lane ahead of the implementation of trade tariffs. Demand for our Cathay Expert solution continued to grow, supported by robust exports of semiconductor machinery from North Asia as well as ad hoc demand out of Europe to Hong Kong.

“Turning to May, we have seen steady replacement cargo from other parts of our network including Southeast Asia during the first half of the month amidst reduced demand from Hong Kong and the Chinese Mainland. We will continue to closely monitor the ongoing developments in the second half.”

HK Express

HK Express carried more than 690,000 passengers in April, marking an increase of 47.4% year on year, while Available Seat Kilometres (ASKs) grew by 42%. In the first four months of 2025, the number of passengers carried increased by 37.6% compared with the same period for 2024.

Lavinia said: “Buoyed by the long-weekend holidays in April, HK Express carried a record number of passengers and operated a record number of flight sectors while continuing to expand its network. Extra sectors to popular destinations like Bangkok, Seoul and Phu Quoc were added over the Ching Ming Festival and Easter amidst strong demand.”

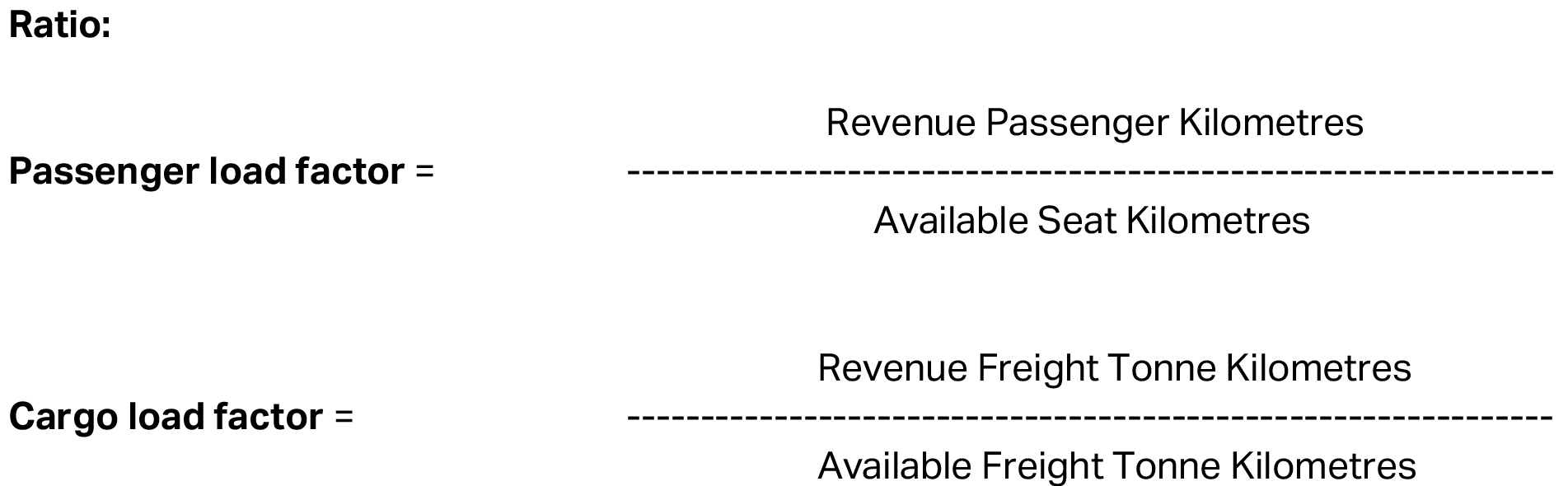

Glossary

Terms:

Available Seat Kilometres (“ASK”)

Passenger seat capacity, measured in seats available for the carriage of passengers on each sector multiplied by the sector distance.

Available Freight Tonne Kilometres (“AFTK”)

Cargo capacity measured in tonnes available for the carriage of freight on each sector multiplied by the sector distance.

Revenue Passenger Kilometres (“RPK”)

Number of passengers carried on each sector multiplied by the sector distance.

Revenue Freight Tonne Kilometres (“RFTK”)

Amount of cargo, measured in tonnes, carried on each sector multiplied by the sector distance.